Rebates are generally available for a limited time and end once a certain amount of solar has been installed.

Is there a rebate through alliant energy for solar panels.

If a wisconsin llc purchases solar panels solely for the manufacture of electricity of which they sell directly to alliant energy as a.

The itc deducts 26 percent of the cost of your solar energy system from your taxes which means big savings for solar shoppers.

Wisconsin s energy efficiency program for trade allies is managed through focus on energy.

Submission of claim form does not guarantee payment.

The consensus on wisconsin solar power rebates and incentives.

Alliant energy reserves the right to modify or end this rebate program at any time without prior notice.

Wisconsin has just passed a feed in tariff so things are going to get even better there for incentives and quicker payback.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing.

Solar renewable energy certificates srecs legislation in some states requires utilities to generate a certain percentage of their electricity from solar power.

There are three main reasons why installing solar panels for homes is so popular in iowa and specifically in the alliant energy territory.

An average sized residential solar.

All equipment must meet certain efficiency requirements listed on the program web site.

The program assists professionals in a.

Visit the focus on energy website to learn more about available rebates and incentives.

Contact us to better understand your current electric rate and what bill savings you might expect if you install a solar pv system.

Rebates can help to further reduce your system costs by 10 to 20 percent.

Alliant customers can still take advantage of the 26 federal solar tax credit to install solar panels until it reduces at the end of 2020.

Alliant energy customers can call the renewable energy hotline at 1 800 972 5325 8 a m.

This achievement puts the building in a class of its own as indian creek nature center is the first commercial building in iowa to pursue net zero energy certification.

One of the best incentives available to solar shoppers in iowa is the federal solar tax credit also referred to as the investment tax credit.

An alliant energy owned solar array built on site delivers enough energy to account for the buildings annual usage.

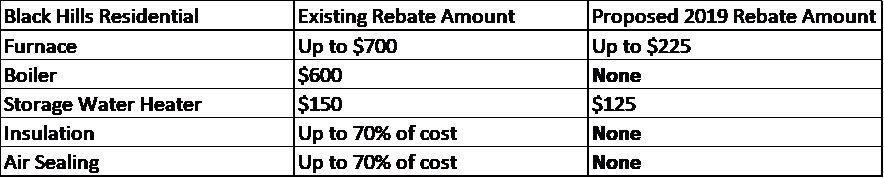

Rebates are available for certain heating insulation water heating and building envelope measures.

Rebates and incentives are offered until approved funds are exhausted or through december 31 2020 whichever comes first.